On this page

Jeton Casinos

On this page

Top 2 Casinos that offer Jeton:

Introduction

Online gambling, as well as online banking practices, have both undergone revolutionary changes and advances during the past decade.

On the one hand...

... customers get much better content when it comes to online gambling platforms. The most notable additions include completely new and innovative gameplay that offers new challenges, and ultimately a new experience. Live dealer games at casinos, as well as live betting at sportsbooks, are one such way to bring the real-life experience closer to the online player pool. With these and additional techniques, operators are definitely contributing to significant progress.

As for the online banking businesses...

... there are a whole new range of companies, payment processing formats, and even currencies. Nowadays, e-merchants and their customers likewise face all different kinds of features, functionalities and entire companies.

Some of these payment processors aim to build upon recognizable and reliable methods, by adding more functionality to existing and established processors. Others, however, aim to completely revolutionize the market with a whole new model for payment facilitation.

There are also those that practice a combination of the best-known credit/debit cards, gift cards and online bank transfers with digital gateways.

Just make sure you are dealing with a reliable company that takes its customers seriously. The top providers offer prime support, excellent security standards and a range of options to tailor your optimal online banking experience.

About Jeton

The Jeton online payment system…

… is provided by London-based company Urus London Limited.

It has been authorized by the Financial Conduct Authority (FCA) of the UK, which lets customers know they are dealing with a reputable service.

As stated on the official website of the payment processor, it services both individuals and businesses, aiming to provide the most suitable local payments that meet everyone’s needs. In this context, businesses such as merchants and resellers can provide up to 27 currencies for customers to choose from.

What is more, the service’s coverage expands over 200 countries, and with 100+ payment methods available for funding purposes, there are much greater chances of customer conversion, retention and ultimately satisfaction.

While businesses benefit from such features, the user base is no less advantaged in terms of their payment experience. After all, the payment method likely offers their local currency, or at the very least one that is generally used in their country of residence.

What is more, Jeton offers…

... two distinct online payment products that can be used combined, as well as separately.

Firstly, there is the fully functional Jeton Wallet – this is an e-wallet payment solution that allows users to register at the platform, get the app from their respective app store – Google Play or Apple App Store – and pay anywhere on the go.

The second type is a Jeton Card.

This is a prepaid card that can be purchased from any of their official retailers and land-based partners, as well as online straight from their service and other reseller marketplaces. Interested customers can get it in any value they deem suitable for their online buying and/or depositing needs, from as little as €10 up to €250.

The currency exchange rate may slightly influence your card balance, but this shouldn’t be a problem as most of the partnering merchants tend to accept payments from multiple currencies. Note that you will be able to use the balance on multiple occasions before you run out of funds, and at a range of excellent platforms.

How to Get Started?

The best way to get started with the Jeton online banking method is by signing up at the platform.

Even though you can get the card solution at a range of venues, having the online e-wallet account is even more convenient and advisable for a fully comprehensive online payment experience.

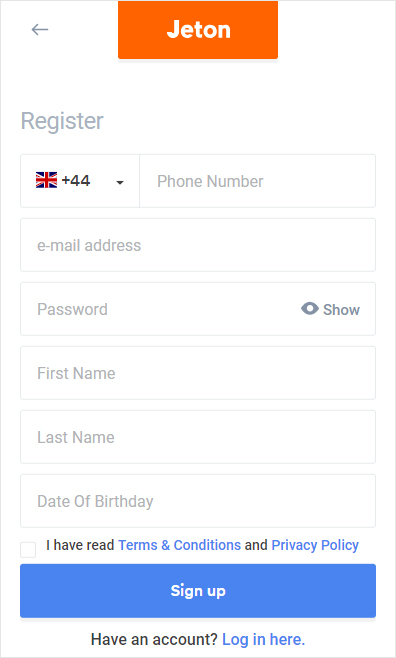

Registration: In order to sign up for using the service, you can access the official Jeton website or download the appropriate app from your mobile device store. Head over to the registration section, where you will be asked to fill in the empty boxes. However, the personal information required by this e-wallet is quite basic, and will not see even the most reluctant of customers sharing data and banking details they’d rather keep private.

A list of all the eligible countries where residents can use the service is also provided during the registration process. Ultimately, you will need to enter your phone number, and thus conclude the signup.

Funding options: Once you have your own Jeton Wallet account, you will need to place some funds in it in order to use it for payments.

One way to fund your e-wallet…

… is through an instant bank transfer. For this purpose, the service would need to have established collaboration with the banks in your country of residence, so only the customers from those territories would be eligible to use this option.

However, there is yet another…

… much more widespread funding option – Visa credit and debit cards. Jeton supports transactions made with Visa cards and accepts it as a worldwide deposit option. Just make sure that the cardholder and the holder of the e-wallet account are the same, as stated in the terms and conditions of the service. This protects you and both your card and e-wallet account from being misused for someone else’s benefit.

Finally, there is…

… naturally the Jeton Card as an available funding option for your Wallet. Buy the card at your convenience and suitable value, and simply input its details in the designated boxes to complete the fund's transfer. You can specify the exact amount you’d like to transfer to your Wallet and save some of the card’s balance for any additional payments.

The card is the ultimate preferred choice of making deposits, or direct payments, due to its specific features. For one, it has a 19-digit CVV code that would be required to authorize any transaction, as well as a separate PIN. It also features a card number and expiration date, all of which function as a separate and fully independent payment method. Hence, you can purchase the card with cash at any location and simply go on using it without associating it with any banking details.

There is no room to worry about the first two funding methods either – the Jeton Wallet is protected with all the latest encryption, carrying PCI- DSS Level 1 certificate. What is more, the service employs constant real-life monitoring and excellent fraud prevention measures. Push notifications are ultimately provided across devices for any up-to-date changes in your account so that you are alerted about each change.

Jeton at Online Casino Sites

Online casino operators, sportsbooks and poker room platforms, as well as other gambling forms, are constantly oriented towards finding the best selection of banking methods for their player needs. Just like game software providers and specific content is meticulously chosen based on reputability, tested fairness and features, these services need to meet equally demanding criteria. Encryption, security, player accessibility and official legal authorization rank top among these requirements, and service operators to identify the top choices for their banking page.

Jeton is a relatively new payment method, representing the newer generation of solutions that aim to combine the tech advances in order to create an accessible and convenient service. On top of that, it packs security measures that make it preferable for online casino players and gamblers alike. Hence, learning how to use it in case you run into the option is definitely a useful read for any player going for the optimal gameplay.

Depositing at Jeton Online Casinos

Step 1: The first thing you will need to do when depositing funds into your casino player account using this method is to check for its availability. Head to the banking page and search for the payment method listed under e-wallets or prepaid cards, depending on the type of transaction they offer, as well as your preferences. Sometimes, it is best if you have already registered and signed up into your player account, just to be sure you get a preview of all the options available.

Step 2: Once you have located the logo of the company at the Cashier, click on it in order to get the transfer started. You will need to provide some information, such as the e-wallet’s address, or alternatively, your card number and expiration date, as well as your personal details. Decide on your bankroll amount and enter it in the designated box before sending the request.

Step 3: To confirm the transaction and your identity, you will need to enter the CVV code of the card which consists of 19-digits. What is more, if you have opted for the dual-factor verification feature, you will most likely need to enter additional information in the marked field – a code, or simply use the Touch ID feature on your mobile device. The Jetop app can integrate this functionality for authentication purposes, which is a much-welcomed benefit for safer and more stable online payments.

Step 4: Funds transfer happens instantly, in real time, allowing players to have the funds available in their account in a matter of moments. Just check the balance of your card/wallet, and at the player account and head on straight to your top choices of slots and table games at the respective casino.

Withdrawing from Online Casino Sites

The best part about any online casino payment method is its ability to process withdrawals along with deposits. Considering that this is not a convenience everyone offers, payment methods that do include it are bound to attract players’ attention.

Fortunately for this payment processor, it offers cashout transactions just as easily as deposits.

Just find the payment method listed in the withdrawal section and go through the procedure.

You should only experience a minor delay in case the casino needs to review your cashout request before clearing it, and still have the funds available as soon as possible. Afterward, you can use your online casino winnings for new deposits, savings, or as funds for the many other merchants and resellers that have Jeton included in their checkout options.

Pros

- Security – The security at this payment processor’s premises is quite exceptional. As mentioned earlier, they are PCI- DSS Level 1 certified, and their operating company has already received authorization from the FCA. What is more, fraud and intrusion prevention measures are also implemented, as well as authentication factors such as a CVV code and even Touch ID verification.

- Customer Support – customer support is highly responsive and made up of knowledgeable and servicing agent representatives. These are accessible through a range of contact channels, such as the 24/7 active live chat. On top of that, there are specific email support addresses for VIP members, regular customer support, as well as general inquiries, business inquiries and compliance questions. On top of that, there is a well-equipped FAQ page on the website, covering all the major points.

- Integration – Most e-commerce platforms shun specific payment processors due to their difficult integration. However, Jeton is built to fit its layout into almost any of the merchant and reseller platforms available and allows for quick, easy and simple checkout for their customers. The same goes for individual users, who won’t have any hard time matching their smartphone or tablet OS with the app.

- Accessibility – The payment service is accessible at a growing number of online platforms and retailers, all over the world. Hence, this has ultimately proven as an added convenience for its users.

Cons

- New payment company – Some users, especially online casino players, are often put off of trying a payment method due to the novelty of its company. However, while this is an inconvenience for some, for others, it is an indicator of the modern approach towards their services and the most up-to-date solution in terms of online payment processing, security and overall service.

- Waiting period – Some complaints have surfaced in regard to the verification waiting period that customers are subject to at the registration. This process is only lengthy due to the numerous tests that need to be conducted by the company to ensure completely legal practices – they need to follow market standards regarding identity theft, know-your-customer compliances and everything in between.

Jeton is popular in these countries

Jeton Casinos

Filter

More filters

FAQs

Are there any fees associated with using Jeton Card or Jeton Wallet at my top favorite online casino?

No, the service is completely free of charge, both when it comes to registration and making payments.

Which are some of the currencies available for these payments? What about exchange rates?

With so many currencies available, players still opt for some of the top used ones in global frames – USD, EUR, GBP. What is interesting is that this payment service additionally includes Bitcoin as an eligible currency option. Including a cryptocurrency is a great step to approaching such finances just like any other, and proof of that is the exchange rate – it is applicable across every currency available, and changes based on the global rate changes.

Where is this payment method available across the globe?

In a worldwide context, this payment method is available practically anywhere where it is legal, but it has definitely achieved greatest popularity in Australia, Bulgaria, Turkey, Canada, Brazil, Malta, Spain, Hong Kong, Finland, Norway, Switzerland and Thailand among other countries.

Name some of the top online casino operators that feature this method in their Banking/Cashier.

Some of the top online casinos which feature this payment method in their banking section include Everum Casino, Vbet Casino, 1xSlots, LuckyBet and more.

Which languages are supported by the service?

Since it aims to cover countries from all parts of the world, the service supports multiple language versions – English, German, Spanish, French, Hungarian, Italian, Polish, Portuguese, Turkish, Bulgarian, Chinese and Japanese.

.jpg)

.jpg)