On this page

Taxable Return from Video Poker

Introduction

Changes in the tax law, effective in 2018, make it much more difficult to deduct gambling losses. The way the tax law has always worked is as follows:

- Enter you "gambling winnings" on line 21 of the 1040 form, titled "other income."

- Enter any offsetting losses on line 28 of Schedule A, assuming you itemize.

- On line 40 of the 1040 form, enter the greater of the itemized deductions on schedule A or the standard deduction.

If you already took the standard deduction before 2018 and had no significant changes in tax situation, then this change in the law probably won't effect you. However, if your total itemized deductions falls between the the standard deduction amounts between 2017 and 2018, then it will. In other words, those filers who plan to take the standard deduction, you won't be able to deduct gambling losses any longer. I personally fall into this group, which is why I have devoted a lot of attention to the topic.

Standard Deduction

| Filing Status | 2017 | 2018 |

|---|---|---|

| Single | $6,350 | $12,000 |

| Married Filing Jointly or Qualifying Widow(er) | $12,700 | $24,000 |

| Married Filing Separately | $6,350 | $12,000 |

| Head of Household | $9,350 | $18,000 |

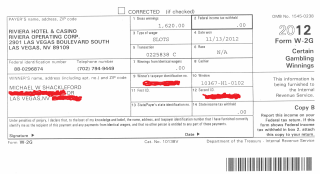

At this point, let me discuss the way you the law says you're supposed to treat gambling wins and losses. According to Revenue Procedure 77-29, Section 3, you are supposed to keep a record of every "session" win or loss along associated details about the session like where, when, and who with. There has been much debate about how to define a "session," but my interpretation is a period of playing uninterrupted by another activity. If you do it this way, enter the sum of all session wins on line 21 of the 1040 form and the sum of all losses on line 28 on Schedule A. If you follow these rules and your declared gambling winnings on line 21 are significantly less than your sum of W2G forms, which the IRS will know about, then you should be prepared to be audited. According to Russell Fox, who does the taxes for professional gamblers, the IRS computer will flag any return where the declared gambling winnings fall well short of the total W2Gs. He says there is about a 50/50 chance this will lead to an audit. If you get audited, then you can expect to fight the IRS for at least a year through their levels of appeal. Assuming you kept good records, you should win in the end.

However, some gamblers value their time and energy too much to fight the IRS on principle. The IRS puts a big emphasis on W2G forms and expects to see an amount on line 21 equal or greater than the sum of all W2G forms. To avoid a confrontation, what most gamblers do is enter the sum of their W2G forms on line 21 and take a deduction on Schedule A of whatever amount will get them to their real gambling win, if there was one, for the year. For gamblers who do their taxes that way and who will take the standard deduction, it means they will pay tax the full way on any wins of $1,200 or more, because you won't be able to offset losses.

The purpose of this page is show the ratio of taxable wins you can expect to have to money bet for various common denominations and number of hands played at once. To calculate the effect for you personally, multiply these ratios by your marginal tax bracket. You can find your marginal tax rate here: IRS.com.

I would like to state for the record that I do not advocate filing a false return. Keeping an accurate gambling log will negate the significance of the W2G form. However, for those who do care about them, this page is for you. It shows the ratio of wins that will be $1,200 or over on various common video poker games for skilled players by the number of hands played at once.

|

|

9-6 Double Double Bonus

The following table shows the ratio of taxable wins to money bet for various denominations and number of hands played at once for 9-6 9-6 Double Double Bonus, which as an expected return of 98.98%.

9-6 Double Double Bonus

| Denom. | 1-play | 3-play | 5-play | 10-play | 25-play | 50-play | 100-play |

|---|---|---|---|---|---|---|---|

| $0.25 | 0.000% | 0.410% | 0.621% | 1.308% | 2.575% | 3.324% | 5.512% |

| $0.50 | 1.961% | 2.777% | 3.201% | 4.412% | 5.295% | 7.417% | 19.694% |

| $1.00 | 4.424% | 5.435% | 6.546% | 7.064% | 9.532% | 19.648% | 26.848% |

| $2.00 | 9.493% | 10.873% | 11.139% | 12.938% | 22.698% | 29.101% | 58.719% |

| $5.00 | 21.267% | 22.038% | 22.782% | 26.955% | |||

| $10.00 | 21.267% | 23.262% | 25.693% | 36.887% | |||

| $25.00 | 21.267% | 36.465% | 45.254% | 70.584% |

For example, consider a player playing 10-play 9-6 Double Double Bonus at the $5 denomination. The table above shows he can expect to have 26.955% of his wins to be $1,200 or over. If this player is in the 24% marginal tax bracket, he can expect to give 26.955% × 24% = 6.469% of his total money bet. That reduces of the effective return of the game from 98.981% to 92.512%.

9-6 Jacks or Better

The following table shows the ratio of taxable wins to money bet for various denominations and number of hands played at once for 9-6 Jacks or Better, which as an expected return of 99.54%.

9-6 Jacks or Better

| Denom. | 1-play | 3-play | 5-play | 10-play | 25-play | 50-play | 100-play |

|---|---|---|---|---|---|---|---|

| $0.25 | 0.000% | 0.150% | 0.177% | 0.238% | 0.464% | 1.260% | 1.484% |

| $0.50 | 1.981% | 1.982% | 1.987% | 2.066% | 2.694% | 2.732% | 6.831% |

| $1.00 | 1.981% | 1.982% | 2.056% | 2.667% | 2.699% | 7.766% | 27.073% |

| $2.00 | 1.981% | 2.052% | 2.658% | 2.687% | 8.406% | 26.707% | 52.732% |

| $5.00 | 2.527% | 3.362% | 3.714% | 10.553% | |||

| $10.00 | 8.434% | 10.574% | 14.333% | 30.712% | |||

| $25.00 | 8.434% | 25.159% | 42.574% | 69.221% |

8-5 Bonus Poker

The following table shows the ratio of taxable wins to money bet for various denominations and number of hands played at once for 8-5 Bonus Poker, which as an expected return of 99.07%.

8-5 Bonus Poker

| Denom. | 1-play | 3-play | 5-play | 10-play | 25-play | 50-play | 100-play |

|---|---|---|---|---|---|---|---|

| $0.25 | 0.000% | 0.150% | 0.177% | 0.239% | 0.833% | 1.442% | 1.705% |

| $0.50 | 1.988% | 1.990% | 1.994% | 2.221% | 2.886% | 3.062% | 8.262% |

| $1.00 | 1.988% | 2.139% | 2.217% | 2.890% | 3.160% | 8.805% | 26.298% |

| $2.00 | 1.988% | 2.481% | 2.960% | 3.161% | 9.631% | 25.956% | 52.282% |

| $5.00 | 4.089% | 5.185% | 6.397% | 12.218% | |||

| $10.00 | 10.298% | 12.275% | 14.420% | 30.597% | |||

| $25.00 | 10.298% | 25.316% | 42.410% | 68.681% |

9-7 Double Bonus Poker

The following table shows the ratio of taxable wins to money bet for various denominations and number of hands played at once for 9-7 Double Bonus Poker, which as an expected return of 99.11%.

9-7 Double Bonus Poker

| Denom. | 1-play | 3-play | 5-play | 10-play | 25-play | 50-play | 100-play |

|---|---|---|---|---|---|---|---|

| $0.25 | 0.000% | 0.150% | 0.176% | 0.533% | 2.035% | 2.326% | 3.804% |

| $0.50 | 1.665% | 1.965% | 1.980% | 3.388% | 3.725% | 5.192% | 18.728% |

| $1.00 | 1.665% | 2.519% | 3.543% | 3.878% | 6.069% | 18.516% | 24.523% |

| $2.00 | 5.169% | 6.746% | 7.010% | 8.827% | 21.071% | 26.059% | 57.971% |

| $5.00 | 17.946% | 18.719% | 19.461% | 25.780% | |||

| $10.00 | 17.946% | 19.943% | 24.554% | 34.714% | |||

| $25.00 | 17.946% | 35.371% | 45.391% | 72.334% |

"Airport" Deuces Wild

The following table shows the ratio of taxable wins to money bet for various denominations and number of hands played at once for 25-15-9-4-4 Deuces Wild, which as an expected return of 98.91%.

Airport Deuces Wild

| Denom. | 1-play | 3-play | 5-play | 10-play | 25-play | 50-play | 100-play |

|---|---|---|---|---|---|---|---|

| $0.25 | 0.000% | 0.149% | 0.543% | 0.601% | 0.787% | 2.073% | 4.145% |

| $0.50 | 1.843% | 2.217% | 2.234% | 2.320% | 3.844% | 5.356% | 11.028% |

| $1.00 | 1.843% | 2.344% | 2.558% | 4.315% | 6.800% | 13.049% | 25.039% |

| $2.00 | 5.583% | 5.697% | 6.273% | 6.915% | 13.203% | 25.620% | 55.904% |

| $5.00 | 5.583% | 6.563% | 7.544% | 13.580% | |||

| $10.00 | 10.364% | 12.200% | 16.706% | 32.485% | |||

| $25.00 | 15.045% | 28.221% | 47.619% | 70.595% |

9-7-4 Triple Double Bonus

The following table shows the ratio of taxable wins to money bet for various denominations and number of hands played at once for 9-7-4 Triple Double Bonus, which as an expected return of 99.58%.

Triple Double Bonus

| Denom. | 1-play | 3-play | 5-play | 10-play | 25-play | 50-play | 100-play |

|---|---|---|---|---|---|---|---|

| $0.25 | 0.000% | 1.610% | 2.160% | 2.930% | 5.041% | 7.032% | 11.018% |

| $0.50 | 7.392% | 8.898% | 9.212% | 10.782% | 12.318% | 15.219% | 22.000% |

| $1.00 | 14.295% | 14.830% | 15.865% | 16.192% | 17.393% | 24.046% | 32.331% |

| $2.00 | 16.665% | 17.977% | 18.180% | 19.171% | 25.618% | 32.893% | 56.951% |

| $5.00 | 27.758% | 28.313% | 28.863% | 32.386% | |||

| $10.00 | 27.758% | 29.238% | 31.673% | 40.003% | |||

| $25.00 | 27.758% | 42.939% | 50.217% | 73.003% |

Bonus Poker Deluxe

The following table shows the ratio of taxable wins to money bet for various denominations and number of hands played at once for 8-5 Bonus Poker Deluxe, which as an expected return of 97.40%.

9-7 Bonus Poker Deluxe

| Denom. | 1-play | 3-play | 5-play | 10-play | 25-play | 50-play | 100-play |

|---|---|---|---|---|---|---|---|

| $0.25 | 0.000% | 0.150% | 0.177% | 0.238% | 2.384% | 2.577% | 3.491% |

| $0.50 | 1.974% | 1.976% | 1.980% | 3.979% | 4.033% | 5.882% | 19.030% |

| $1.00 | 1.974% | 3.910% | 4.046% | 4.401% | 7.261% | 18.428% | 23.517% |

| $2.00 | 1.974% | 4.628% | 5.290% | 7.033% | 18.654% | 28.919% | 59.414% |

| $5.00 | 21.380% | 22.127% | 22.847% | 26.587% | |||

| $10.00 | 21.380% | 23.307% | 25.403% | 35.731% | |||

| $25.00 | 21.380% | 34.881% | 43.357% | 68.305% |

External Links

- Discussion about taxation on jackpots — At my forum at Wizard of Vegas.

- Revenue Procedure 77-29, Section 3 — How to keep a record of gambling wins and losses

- Podcast of tax professional Russell Fox — Gambling with an Edge podcast Nov. 9, 2017.

- Gambling & Taxes (U.S. income tax) by Michael Bluejay

- W2G instructions from IRS.gov.

- 2018 Tax Rates and Brackets from IRS.gov.

- Safe Harbor Method for Determining a Wagering Gain or Loss from Slot Machine Play from IRS.gov. As I understand it, this document is more of a proposal and was never ratified.