On this page

Western Union Casinos

On this page

Top 3 Casinos that offer Western Union:

Introduction

Sending money in a safe and timely manner has always been a major convenience in everyday life. For a long time, quite a limited portion of the world population had been able to enjoy such services, especially in the middle 19th century, as societies were just entering and adapting to the industrial progress of the age.

With the first remote and especially overseas employment sites, people grew more and more needy of a viable money management solution. This practice has continued up until today, along with its tendency to seek out better payment processing methods.

Nowadays, aside from the old, standard cash transfers, new businesses have put forward their fair share of payment services on the global marketplace. These include e-wallets which allow completely digital fund storage, along with a range of intermediary services that focus on functionality. The latter, in particular, will get your funds across without so much as leaving a trail of their existence; yet people all over the world are often wary of these conveniences.

After all, individuals are greatly concerned about the cost, security, speed and reliability among other factors. Thus, in order to make completely convenient transactions, people ultimately turn to a handful of such services that have a proven track record, and Western Union is one of the top choices.

About the Payment Service

A company whose origins date all the way back to 1851 is bound to offer a thing or two in quality in order to surpass the passage of time. What is interesting about it is that, back then, it started out as two major competitor businesses.

At the time, Ezra Cornell reactivated one of his bankrupt businesses under the new brand – New York & Western Union Telegraph Company. His competitor, Hiram Sibley’s The Western Union Telegraph Company came into existence around the same time, and both companies continued to come up against each other for the next four years. Ultimately, in 1855, they concluded that a joint effort would see them profit much more than a constant rivalry, thus giving birth to the Western Union as it is known nowadays.

The company made great profits from both their cash transfer services, and their telegram contact channels. By 1871, they became independent of banking institutions for all their funds transfer, and started processing payments separately, with their own network of WU agents. The telegraph service was flourishing just as well, and was ultimately abolished in 2006 after final attempts to keep it sustainable. With barely 20.000 telegrams sent that year due to the massive use of letters, email and SMS texts, WU cut off their long-standing service.

Nevertheless, their other piece of the trade – the cash transfer business, had already become their primary operation back in the mid 90s. Around 1943, the service had attracted over 500 competitors, and despite maintaining market monopoly, was largely deprived of their market share. Around the 80s, the company ultimately managed to set into firmer grounds, and hasn’t been shaken as severely ever since.

Western Union Cash Transfer Services

This type of service prevailed and is still offered nowadays by branch offices of Western Union all over the world. According to 2013 records, a total of $79 billion were transacted across 231 million consumers and 432 million business payments.

By 2018, the official website of the service notes significant progress – over $300 billion transacted at an average rate of 34 payments processed per second. This volume is achieved through more than 550.000+ agent office locations worldwide, using a total of 13 of the most used currencies.

There are over 200 countries where people can use the WU’s diverse funds transfer options, and most of them are eligible to choose from all of them.

When it comes to sending money, users can perform the transaction in four different ways:

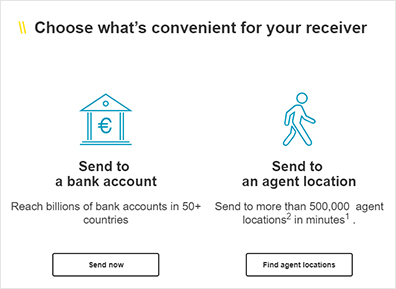

- In person: For in-person transactions, the WU official website helps interested customers by providing them with dedicated agent locator functionality. All you need to do is enter your country of residence, and narrow the search down to your city or zip code. Afterwards, all you need to do is head to the location, provide your own and the recipient’s personal information, as well as the amount you would like to send in cash (plus the transaction fee).

- By phone: For customers from the US, there is a specific toll-free phone number 1-800-CALL-CASH that they can dial in order to execute a transfer. The same procedure applies in terms of providing information, as well as some additional banking details.

- Online: Since the rise of online payment processing, WU has worked to keep up with the latest trends. Hence, its users can simply open their website and perform a cash transfer from the specific, SSL-encrypted page without any hassle.

- Via the WU app: The same tendency expanded to cover mobile transactions, as smartphones grew in popularity and functionality. The dedicated WU app is downloadable through both the Google Play Store and the Apple App Store, for Android mobile devices, iPhones and iPads alike. This app will allow for payments transfer, tracking and status updates, and transaction records on the move, which is particularly convenient for today’s modern fast-paced lifestyle.

Recipients of these transfers can equally choose the way they would like to obtain the cash, with the following options at their disposal:

- In cash: For those who would like to get the full amount in cash, just head to any of the agent locations nearest to your place of residence and provide the necessary ID.

- Bank account transfer: Payment recipients who want their funds to head straight to their bank account will need to provide their account number to the sender, so that it can serve as a payment destination.

- Mobile wallet: Residents of several countries are provided with the added convenience of receiving payments to a specific mobile e-wallet. The specific countries, with their corresponding wallet option are as follows: Afghanistan – Roshan, Bangladesh – Banglalink, El Salvador, Guatemala and Paraguay can use Tigo, Kenya – Safaricom M-PESA, Madagascar – Telma M-VOLA, Philippines – Globe GCASH and SMART Money, Tanzania – Vodacom, Vietnam – Military Bank and Uganda – MTN.

- Prepaid card: This is a more recent option provided by a joint partnership between Western Union and NetSpend, through the MasterCard network. The WU NetSpend Prepaid MasterCard functions as any other prepaid card, and is further advantageous due to the fact it’s accepted at any MasterCard location.

In this regard, there is one final notable feature of these transactions that is essential to making a successful funds transfer. Senders who have executed the transfer using any of the aforementioned options will be provided a MTCN – Money Transfer Control Number. They are supposed to share this number as a unique ID of their transaction with the funds recipient, so that they can claim the funds at the other end. Additionally, it is used for tracking purposes – just enter the number in the payment tracking feature on the website or app and watch the transfer reach its destination.

Using Western Union at Online Casino Sites

A payment processor of this magnitude was only expected to find its way to one of the most rapidly growing industries – interactive gambling. Interested players have developed all kinds of betting strategies, gameplay skills and even math calculations like card counting in order to get the upper hand against the house.

Choosing the right payment method is just as crucial in these attempts – suitable processing fees, times and amount limits are potentially able to affect gameplay outcomes. This cash transfer service has proven to be a particularly fitting banking method, especially for US casino players that have been facing legal obstacles through the years.

Western Union for Online Casino Deposits

Step 1: Before you get your shoes on and head to the nearest WU agent location, it is advisable to look into your online casino banking details. The WU logo should be among the banking methods listed there in order for you to be able to make payments using it. If you find it there, log in or register to the casino platform and get started.

Step 2: Senders can make the deposit as they seem fitting, but the recipient, in this case the casino operator, needs to specify the way they’d like to receive the funds. Thus, when choosing WU as a banking method, you will mostly need to contact customer support as well. They will provide you with all the recipient information you need to make the pay-in.

Step 3: Next off, go to your nearest location or do the transfer online, via phone or through the dedicated app for your mobile device. Either way, don’t forget to enter all information precisely as in your ID documents, and the same goes for those provided by the casino. Once you pay the amount, as well as the transaction fee, you will be provided with the MTCN.

Step 4: In order to see the funds in your casino account, head straight to your site, contact support once again and share this number with your appointed representative. This way, they will be able to identify your deposit amongst others’, crediting your player account with the received sum. Shortly afterwards, players are all set and ready to get started with their real money online casino gameplay.

WU Withdrawals from Online Casino Sites

Online casino players that have spent some time on their favourite site are quite likely to hit a win or two along the way. Considering they have cleared all player requirements for any claimed bonus offers or promotions, they will be eligible to request a cashout next.

However, Western Union is commonly present as a deposit option, while other alternatives are available for cashout transactions. The nature of the service, as well as the specifics of the procedure mainly prevents the cash transfer company from including such options in their offering. Legal obstacles are, in addition, quite present when it comes to these withdrawals, which is why players are best off with an eligible withdrawal method listed in their bank account.

Pros

- Global coverage – A company with reliable origin and nearly two centuries worth of impeccable track record is bound to have achieved massive coverage over the years. Western Union is currently available in over 200 countries, most of them eligible to choose from practically all payment services available.

- Security – They have built their reputation mostly thanks to the safety and security of their transactions. Newer transactions through online channels are no less protected, with all kinds of encryption and anonymity certificates to prevent third party intrusion.

- Customization – Customizing your experience is fully available at WU – senders can choose between depositing options, while recipients have just as many variants when claiming the funds. All the while, customers are additionally able to customize their experience by choice of local office, currency, money transfer service (money orders, prepayments, bills payment), all the way to the design of their WU NetSpend Prepaid MasterCard.

- Transaction speed – Transfers have continuously improved in speed and efficiency over the years, showing the company’s dedication towards customer satisfaction. Most recently, they have been able to perform fast transactions that have users’ funds ready in no time.

Cons

- Withdrawal restrictions – The fact that WU is not used for casino withdrawals is somewhat an inconvenience for players. They normally have a range of options to choose from when requesting a cashout, but the lack of this option certainly narrows down the selection.

- Fee charges – The service has been sustaining itself all these years with the help of fee charges – a set percentage of the amount sent via their channels. That way, they are paid for the service they provide, and have enough financial power to continue providing it at top rates.

Western Union Casinos

Filter

More filters

If we have jumped the gun, you can remove that filter by clicking here.

FAQs

What are some suitable online casino banking methods as an alternative to Western Union?

Online casino players that aren’t eligible to use WU as a banking method can freely turn to other services that operate similarly, such as MoneyGram and Ria. Otherwise, there is a range of credit and debit card services, or modern e-wallet options to choose from.

Are there any limits in regard to the amount you can send or receive through the service?

The service does not impose any amounts on its customers; however, some country restrictions or policies may dictate successful and safe transaction up to a certain amount. What is more, considering the percentage concept of the fee charges, massive sums may end up hurting users’ pockets instead of assisting them.

Is there any customer support I could address in case of inquiries or complaints?

Yes, players and customers in general can address support through the contact form or the contact information available straight from the official website. What is more, there is a well-equipped FAQ page that may prove just as handy.

Which are some of the top WU online casino sites I could try?

The WU online casino top picks mainly include Jackpot Capital, PlayBlackjack, JellyBean Casino, Ramses Gold and more.

Is WU really used for business payments as well as personal transactions?

Yes, this service is widely used by businesses and corporations, looking to systematize and regulate their cash management. It serves as a cost-effective strategy for financial operations of all kinds of NGOs, educational and financial institutions, as well as both small and medium businesses and Fortune 500 companies.