On this page

Poli Online Casinos

On this page

Top 3 Casinos that offer Poli:

Introduction

In a dominantly technological age as today, people have been able to simplify many everyday tasks and activities. They are able to connect to other individuals across the globe, find employment at multiple online job services, or just research information, find their favorite entertainment content and what not.

Such great potential…

…for sharing and distribution of data understandably needs to be accompanied by proper security measures. Online platforms of all kinds have opted to ensure safety and anonymity of their customers and visitors, so as to eliminate the threat of malicious intrusions. With identity thefts and funds abuse as primary concerns, these measures needed to meet certain standards in order to ensure safe use of all services.

In this regard…

…financial institutions were among the most, but not the only ones, concerned about the matter of security. Special authorities have been set up in order to regulate the industry and all operations of the respective banks and financial institutions.

On the other hand…

…new payment services have been set up in order to meet the needs of consumers globally, both in terms of security and convenience. These include e-wallets, cryptocurrencies and specific payment processing solutions that facilitate the new cashless method of funds transfer. Among the most beneficial options for both online merchants and their customers is POLi.

About the Service

This service dates back to 2006, when it was first established under the ownership of Centricom Pty. Ltd. Trading, in Melbourne, Australia. Being part of Australia Post, the company had enough credibility to gain the attention of the public, and build up a sustainable user base. Nowadays, it is considered to be one of the top payment facilitation services on the territories of Australia and New Zealand, with convincing attempts to successfully expand in novel marketplaces.

Further proof…

…of the payment processing service’s success is the prestigious recognition they have received at the first ever e-Gaming Review Awards Australia, held in Sydney back in 2014. The company’s payment solution earned them the “Payment Provider of the Year” award, and with due right. Even its name is a subtle tribute to their main operations – it is an abbreviation for ‘Pay Online’.

How Does It Work?

In order to use the POLi payment option, with the payment details page named Pay Anyone, consumers are advised to visit the official service’s website or a range of online review pages such as this one. Thus, they would be properly introduced to the mechanics behind the process, the actual procedure and the multiple online merchants which offer it as a payment method.

First off…

…enthusiastic customers should check for the availability of this payment option at their chosen online merchant. Whilst the service has been rapidly expanding due to the many benefits it offers to such businesses, it is still best to make sure beforehand and have an alternative ready at all times.

Provided that…

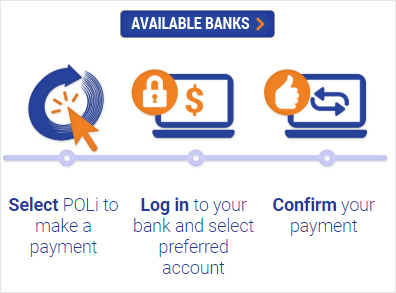

…this service is available, interested users will only need to click on the icon in order to begin using the service. Prior to it, don’t forget to download and install the specific software on their device before continuing with the transaction. However, most of these merchants include a link that will identify your system specifications and allow you to download the suitable software. Once this is done, start the payment by clicking on the service, and then selecting your bank from the list of available ones that have partnered with the service.

After all…

…this payment processor does not require user signups and logins, but simply acts as an intermediary or a proxy between the funds sender and recipient, or more precisely, their respective bank accounts. Should you hold an account at any of the given banking and financial institutions, you can choose it from the list and proceed with the payment.

The internet banking platform…

…of your selected bank will appear next on the screen of your device. Account holders are naturally familiar with the proper way to handle their online banking accounts, adding further convenience to the overall payment experience. Just use your regular credentials – username and password to enter the internet banking platform and choose from which account you would like to use the funds for the transaction.

A form with some pre-filled fields will appear next, ensuring you don’t have to waste any more time than necessary to complete the payment. Just enter the remaining information such as the amount of funds you need, or any additional identification you may use, like single-use codes for dual-factor authorization.

Afterwards…

…it is up to the POLi intermediary services to take the funds from the payer’s bank account and deliver them safely through the proxy channel to the receiving merchant. This is conducted in real time, and as soon as the funds reach their end destination, both parties receive a confirmation email from the service, in case of billing requirements later on.

Available Banks

As mentioned at the beginning of the text, and later on as well, this payment method is restrictively used by Australia and New Zealand residents. What is more, not all banks in these two countries have partnered with the service, and only the ones listed at the official website are eligible.

For Australia, those are the following banks:

- CUA

- Bank of Melbourne

- ME Bank

- St. George Bank

- Westpac

- Bankwest

- BOQ

- NAB

- People’s Choice Credit Union

- IMB Building Society

- Bendigo Bank

- ANZ

- BankSA

- Suncorp

- Commonwealth Bank

- Citibank

- Newcastle Permanent

As for New Zealand residents, account holders from the following banks are able to qualify for the payment processing service:

- ANZ

- ASB

- Kiwibank

- Bank of New Zealand

- TSB Bank

- Westpac

System Requirements

Considering you will need to download and install the software at the device you are intending to use, it is most important that they are able to support it and the operations performed through it. Thus, the official website states the specific browsers and operative systems requirements.

The former consists of:

- Microsoft Edge

- Internet Explorer 8 or more. Set up to allow pop-ups

- Google Chrome

- Firefox 12 or more, with the possibility of having to enable JavaScript

- Apple Safari 5 or more,

while the latter lists the following OSs:

- Windows Server 2003

- Windows Server 2008

- Windows 7

- Windows 8 (or 8.1)

- Windows 10

- Windows Vista

- Mac OS

Some cases, although this could depend more on the merchant than the actual payment service, you will also need to enable cookies in order to experience the full services of the POLi funds transfer. The ‘Pay Anyone’ or ‘3rd Party Payment’ feature may also need to be allowed from your internet banking profile, so that your banking institution is informed that these transactions are made at your will.

POLi as an Online Casino Banking Method

The online casino and gambling industry in general, have been at most need of multiple payment processing services. This is both due to the strict security regulations they need to adhere to, and due to the competitiveness of the industry.

With low maintenance costs and massive gains, there is practically an optimal business climate for the development of such establishments, but greater customer satisfaction, improved performances and ultimately higher financial gain is established through quality and diverse fundamentals. This service is definitely one.

Making Online Casino Deposits

Step 1: Just like performing any payment at an online merchant, online players should start off with an overview of the availability of the service among the payment methods. Once you find it, or the casino destination that allows such payments whilst meeting your software selection, bonus, site functionality and similar requirements.

Step 2: Make sure you register or sign up with your existing casino player account at the platform, and head for the Cashier/Banking section. Select the service from the list of online payment processors and make sure you have the software downloaded and installed on the same device. Just pick the bank you use from the list of financial partners, and proceed to access your regular internet banking service as you would.

Step 3: Since the service acts as an intermediary proxy, they also transfer the details of the transaction, filling up several fields of the payment form beforehand. Just complete the form by entering the required information in the remaining boxes and confirm the transaction. Since payments are processed in real time, you and the merchant will each get an immediate email notification of the completion.

Step 4: Just return to the casino platform and check for your funds – transactions are instantaneous with this payment proxy, but that doesn’t mean that Australian Casino sites, as well as New Zealand-oriented are always able to process POLi deposits as they come. One thing you can be sure in – patience does pay off with this banking method.

Requesting Online Casino Withdrawals

Assuming you have been lucky enough to meet pending conditions and requirements, accumulate a certain amount of winnings and request a cashout with this payment provider, make sure to follow all the steps listed above. Start from the checks for availability of the service, and move through the process – the same choice of options will allow you to choose the bank account where you would like to see the funds credited. Ultimately, go ahead at your local bank office and withdraw them as hard cash.

However, in order to be able to make such requests for withdrawals from a merchant through the proxy to your bank account, you will now need to formally sign up at the payment processing website. By creating a profile, you are providing the service with all the necessary information to remain compliant with KYC and similar regulatory standards. Other than this, and a small charge of $0.30 and 0.9% of the transaction amount, you should not experience any surprises or obstacles along the cashout process.

Advantages & Disadvantages of the Service

- Security – The service offers top security, which is proven through the openly provided certificates, names and information of audits, as well as the 2048-bit SSL encryption socket used to perform funds and information transfer. With the added fact of eliminating the need to share credit or debit card details, they protect players both from identity theft, and the potential of falling into credit card debt.

- Accessibility – Depositing players don’t even need to sign up or pay a dime, meaning it is a service that gives them the best value for their time and money. What is more, it is simple, intuitive, and made with an easy-to-use layout.

- Convenience – In relation to the layout just mentioned, its simple yet functional look has permitted the software to be made compatible with all devices. Players can now enjoy the service through a desktop, tablet or mobile-optimized merchants.

- No credit/debit card – As mentioned earlier, Visa, MasterCard and similar credit and debit card companies face security issues regarding online payments, and consequently put people off this practice. Now, there are ways to bypass it without any loss of quality of the transaction.

- Merchant benefits – The service openly states on the website that merchants will also enjoy multiple benefits. Considering that their prosperity depends on customer satisfaction, added variety of payment options that offer services at no user charge is definitely an indicator of a dedicated merchant. From more traffic, to higher profits, POLi optimizes the perks for everyone involved.

Most complaints about the service have ended up resolved in their favor, but there are still some shortcomings about the offering in general.

- Country restrictions – Despite attempts at expansion, the service is still rather limited in market coverage. Until the promising prospects turn to reality, most users consider this as a disadvantage.

- Small fee for cashout/merchants – The payment proxy has found a way to build a sustainable business – they charge their partnering merchants a small fee of 1% of the transaction value, capped at $3. This allows merchants to receive massive funds for minimum charge.

Poli is popular in these countries

Poli Casinos

Filter

More filters

If we have jumped the gun, you can remove that filter by clicking here.

FAQs

Is there a licensing authority that POLi abides by?

As stated in the official service’s Support section, the service is excluded from the ASIC in relation to the official requirements, but still meets and somewhat surpasses industry standards.

What are examples of online merchants and platforms where I can use this service to perform payments?

You can use this method to pay at multiple airline and travel platforms such as Qatar Airways, online merchants – CMC markets and Microsoft, as well as the top Australian and New Zealand online casinos and the top sportsbooks.

How is the service benefiting the merchants in terms of integration onto their platform?

By providing a range of options through which merchants can charge their customers, the service is largely benefiting their partners. The specific means of integration available for them are checkout via API or via plug-in, POLi link via API or no integration at all, i.e. by generating a link for the charges.

What are the top suitable alternatives to the payment method for players under US laws or other jurisdictions that prohibit these financial operation services?

Since the service is based on internet banking, it would be as suitable an alternative as the many online processors – PayPal, Neteller and the likes.

Will there be any online casino player benefits available – bonuses or rewards program?

The service itself doesn’t offer any benefits, but the bank you are using for your linked account might be of the type. Moreover, most online casino and gambling operators have identified the perks of player payments with this method, and thus prompt them through numerous general and dedicated bonus offers and promotions.